Bank of England was dangerously tight-lipped in yesterday’s crisis

In the film Goldeneye, James Bond confronts a rogue MI6 agent and a rogue post-Soviet general who couldn’t quite let that Cold War rivalry pass quietly into history. Ever trying to follow the zeitgeist, the Bond producers equipped the villains with a diabolically modern plan: they would rob the Bank of England electronically, then fire an electro-magnetic pulse at London to destroy any trace of the theft.

Yesterday, a less dramatic and quite accidental version of the same events took place. The BoE’s payments system, called CHAPS, just … broke. It’s not yet clear what happened. By 4pm Monday,  the system was fixed, but in the meantime the story won a lot of attention. Upon this payments system depends the UK’s financial system, and a bunch of other industries to boot. Estate agents’ press departments, in particular, spent the better part of the day bemoaning the glitch’s impact on their buy and sell chains. Even the Law Society kicked off. By day’s end, Andrew Tyrie MP was demanding answers.

the system was fixed, but in the meantime the story won a lot of attention. Upon this payments system depends the UK’s financial system, and a bunch of other industries to boot. Estate agents’ press departments, in particular, spent the better part of the day bemoaning the glitch’s impact on their buy and sell chains. Even the Law Society kicked off. By day’s end, Andrew Tyrie MP was demanding answers.

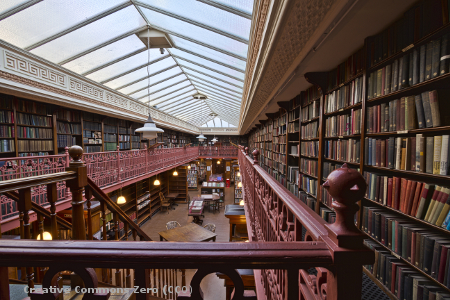

It’s an interesting opportunity to reflect on the Bank’s communications, as well as on the obvious questions of security and resilience. Over the last decade, the Bank has “opened up”, like the ideal patient on a psychiatrist’s couch. In monetary policy, forward guidance has been the order of the day. The Bank has a museum – this opened in 1988 – and a popular Twitter account with almost 100,000 followers. In 2013, for the first time, it opened The Governor’s office doors to the public for Open House London Weekend. If you wondered, it is modest, quite dignified, and opens onto a garden.

Nowadays, the Bank likes to talk. Yesterday, however, the Bank reverted to historical trend: magisterially aloof, and tight-lipped. “Never explain, never apologise” was once, supposedly, the Bank’s doctrine. This principle was followed to the letter on Monday. As transactions queued up to await execution by the payments system, the Bank and CHAPS – the independent company that operates the system – made only two, quite sparse statements each. They offered no explanation, and they certainly offered no apology (see here and here). Come Monday evening, the Bank made a further statement, of just 71 words, announcing an independent review.

Even with yesterday’s relatively inconsequential payments jam, news media took a great deal of interest in the story. It occupied the Guardian’s Business Live blog for much of the day, and was front page story on the Financial Times’ website throughout the afternoon. This morning, it is on the FT’s front page. The Telegraph exhibited its usual concern for homeowners’ welfare, reporting that 2,450 sales were delayed by the “gremlin” in the payments machine.

A giant in the world of finance

However, in the absence of any actual victims or crisis, journalists felt little need to speculate about exactly what had gone wrong, or to invoke Nostradamus and the end of the world. Cooler heads prevailed, and so the Bank’s decision to provide no further information seems, retrospectively, unremarkable. One might even argue that the Bank’s strong, silent approach conveyed confidence. Like the worldly Wilcoxes in Howards End, or the bankers at the Dawes Tomes Mousley Grubbs Fidelity Fiduciary Bank, the bowler-hatted men have caught the ball. They always have, and they always will, so please let the masters of the universe get on with their jobs.

But there two arguments for openness. The first is counter-factual. Luckily, there was no crisis yesterday. But the Bank got away with it more narrowly than it would appear. Last week, volatility returned to global markets after a prolonged absence, and we got a reminder of what rocky markets look like.

Had today’s freeze taken place at a difficult moment – say, in September 2007, when the liquidity crisis broke Northern Rock – it would not have been taken so calmly. In bad times, confidence in the Bank’s ability to provide liquidity rapidly underpins all lending, and keeps depositors from mobbing the ATMs. Perhaps the Bank would have said more in such a crisis – to stem speculation, to correct misapprehensions, or to reassure with more facts and figures. But the Bank’s reversion to historical type suggests a curious, lingering tendency to lock the steel doors, and to release nothing but the barest facts. Perhaps, in a crisis, the news story might have spun out of the Bank’s control?

The second argument concerns what happens next. The Bank understands the importance of resilience, and wrote about the issue very recently. Andrew Tyrie has already spoken, so it is likely that Mark Carney or a senior official will soon be sitting in front of the Treasury Select Committee. Unlike in Montagu Norman’s days as Bank Governor, Mr Carney will not be able to give wry smiles in place of actual answers. So the Bank will eventually have to be open about what happened. Instead of clearing the story off the front pages and into the business pages in under 24 hours, the issue will most likely resurface for a second time in the coming days. This isn’t a massive problem for the Bank, but it doesn’t help with confidence, and needlessly drags the story across the news horizon. Needlessly, that is, unless the Bank genuinely has no idea what happened – which is unlikely.

From these angles, the Bank’s decision to keep schtum looks questionable. We won’t be the only people saying this, and we expect pressure for openness to increase, just as the Bank has been challenged to publish tape-recorded MPC meetings. From the (commercial) viewpoint of a PR firm, we can round off by saying that the BoE’s performance yesterday was very far from unique. Fortunately for us, being big, being prestigious, and being very rich definitely do not guarantee that an organisation knows how to communicate.